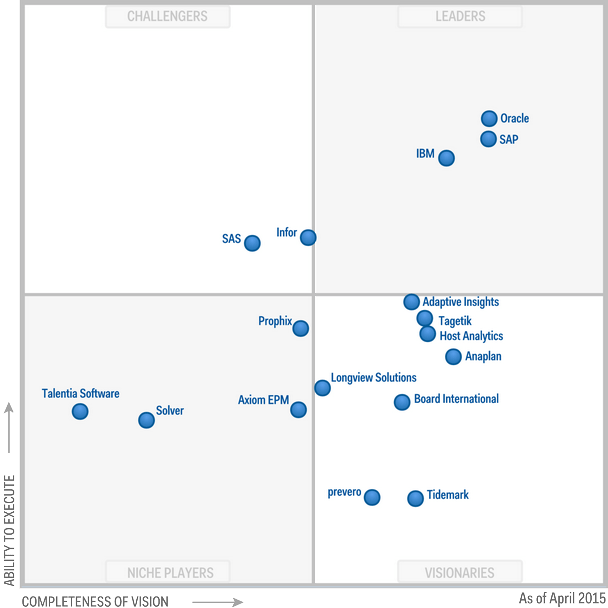

Gartner Magic Quadrant for CPM Suites (Corporate Performance Management) is one of most famous benchmarks in the EPM market, which can help you to better understand the positioning of the different software vendors and find the one that could fit your needs…or to improve the way you´re using your current reporting or finance software.

Gartner has conducted a survey of organizations using CPM products, representing companies headquartered across six different geographic regions, mostly in Western Europe (29%) and North America (56%).

In order to use this study for taking decisions, we should go beyond one graphic, remember that the Magic Quadrant document is one graphic and 34 page of text.

Let´s start with the basics, according to Gartner, Corporate Performance Management suites facilitate efficient, compliant and transparent processes within the office of finance. They also enable CFOs and other business leaders to manage organizational performance and guide strategic direction.

CPM is also known as Enterprise Performance Management (EPM) and Financial Performance Management (FPM)… it’s just different ways to call it.

Although is a new year, it would seem not much has changed in the MQ for CPM in 2015, so how´s the market evolving?

Gartner evaluates the companies according to two criteria: Ability to execute (Product/service, overall viability, sales execution/pricing, market responsiveness/record, marketing execution, customer experience, operations)

and completeness of vision (Market understanding, marketing strategy, sales strategy, offering strategy, business model, vertical/industry strategy, geographic strategy).

The following graph displays the companies on the Magic Quadrant, but there are more CPM software vendors that are excluded for minor market share reasons.

Here are some highlights taking into account Gartner research and its context:

• Oracle, SAP and IBM are ahead but innovators have taken more control of the MQ and have pushed the leaders back on both Completeness of Vision and Ability to Execute. The new players are Anaplan, Talentia Software and Tidemark…and the ones dropped from last year KCI Computing and Bitam.

• CPM cloud momentum; niche players and visionary innovators are developing cloud capabilities…the biggest vendors are following the trend too.

• Collaborative workflows; collaborative financial planning is growing with new analytics, cloud and in-memory capabilities. The goal is to improve coordination between strategic financial and operational planning. For example, Board International‘s version 9 included a number of features to support more collaborative corporate planning, such as mobile data entry.

• ERP and CPM close to join processes; integration and platform-related capabilities are growing in importance…in the next future, there will be new possibilities.

You can check each vendor strengths and cautions to have an overview about its potential. Also, to further investigate product and service ratings based on key capabilities, you can check Gartner Critical Capabilities. I invite you to read the full Gartner MQ to have your own conclusions in order to choose your CPM or to enhance its use.

About the Magic Quadrant

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.